With a comprehensive range of products based on solid experience, Amundi provides well-adapted and clear solutions to investors seeking both liquidity and performance in an increasingly restrictive environment.

With a comprehensive range of products based on solid experience, Amundi provides well-adapted and clear solutions to investors seeking both liquidity and performance in an increasingly restrictive environment.

With more than USD 255 billion of assets under management1, Amundi is a leading provider of treasury management services globally. Whether for traditional money market funds or enhanced short-term solutions, we aim to achieve the high standards expected of us as one of the world leaders in asset management. These high standards are reflected in our unwavering attitude towards investment security.

Amundi is amongst the few asset managers that witnessed growth in treasury management funds during the financial crisis. This, we believe, is due to our extensive range of fully transparent products which combine performance potential with liquidity.

| A comprehensive range of money market and short-term investment vehicles |

Products combining security, liquidity, transparency and consistent performance |

Easy access to money markets at competitive prices |

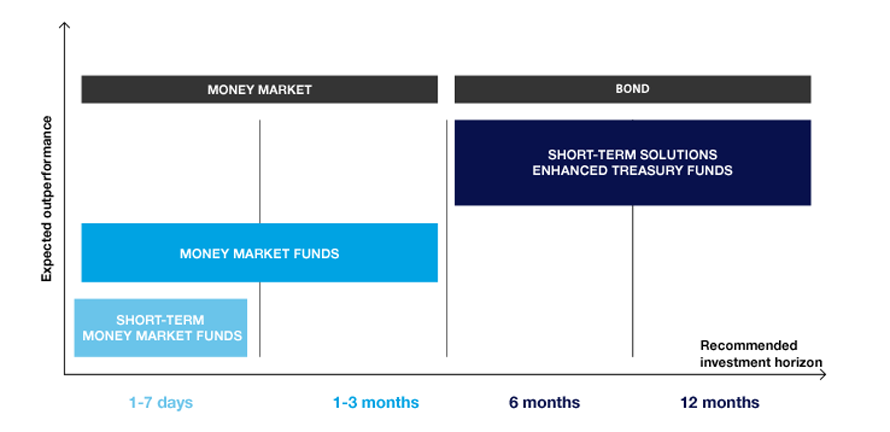

Our fund range covers all maturities up to 24 months and can be adapted to match your performance objectives. All our solutions are managed using our robust and proven investment processes which date back to the early 2000s.

Amundi offers a wide range of traditional money market strategies and short-term money solutions to manage cash on a daily basis. These solutions provide what our clients require the most: security, liquidity, transparency and consistent performance.

Our long-term treasury products seek to exploit interest rate premium through active duration monitoring and rigorous stock selection. These funds seek to offer higher returns than traditional money market funds.

USD 255

bn of AuM1

50

dedicated investment professionals1

3,000

institutional and corporate clients1

Amundi's comprehensive range includes the more traditional short to mid-term liquidity solutions as well as an enhanced treasury range for investors looking for slightly higher returns.

For illustration only. Subject to change without notice.

Security, transparency, liquidity. It is our responsibility to build quality portfolios within strict limits.

Patrick Siméon, Head of Money Market Management

1 - Source: Amundi, as of December 31, 2019.

The information on this website is prepared by Amundi Malaysia Sdn. Bhd. and Amundi Islamic Malaysia SDn. Bhd. (collectively know as "Amundi Malaysia") and reflects, as of the date hereof, the views of Amundi Malaysia (or its applicable affiliate providing the publication) (“Amundi”) and sources believed by Amundi to be reliable. For avoidance of doubt, Amundi Islamic Malaysia Sdn. Bhd. shall only carry out Islamic fund management activities. No representation or warranty is made concerning the accuracy of any data compiled herein. In addition, there can be no guarantee that any projection, forecast or opinion in these publications will be realized. Past performance and any forecasts made are not indicative of future performance. Any opinion or view expressed herein is subject to change without notice. These publications are provided for information purposes only, and under no circumstances may any information contained herein be construed as investment advice. The information contained herein does not take into account your particular investment objectives, financial situation, or needs, and you should seek professional advice before making any investment decisions. Any information contained herein may not be construed as any sales or marketing materials in respect of, or an offer or solicitation for the purchase or sale of, any financial instrument, product or service provided by Amundi and its affiliated companies. References to specific securities in the publications are presented solely in the context of industry/country analysis and are not to be considered recommendations by Amundi and its affiliated companies. Amundi and its affiliated companies do not accept any liability whatsoever whether direct or indirect that may arise from the use of information on this website. Amundi, its associates, directors, connected parties and/or employees may from time to time have interests and or underwriting commitments in the investments described herein. The information on this website is not intended for “US Persons”, as defined in the Securities and Exchange Commission’s “Regulation S” under the 1933 U.S. Securities Act.