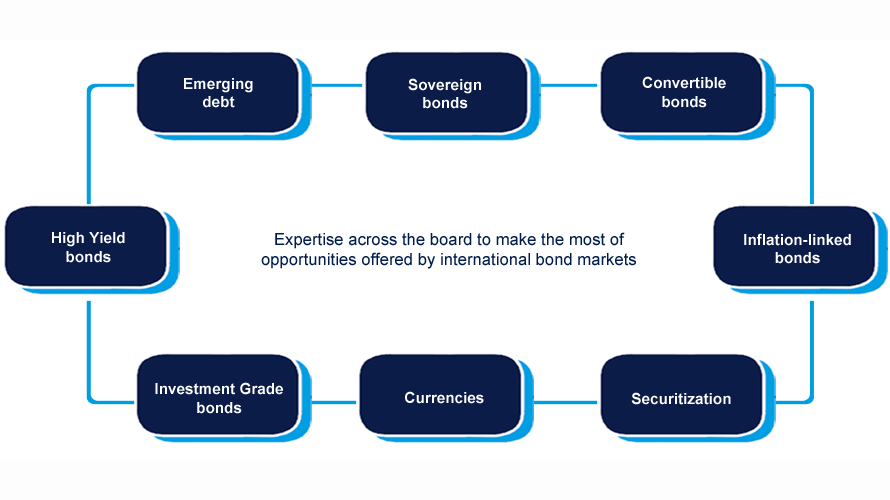

With an AuM of USD 887 billion in fixed income1, Amundi is one of the largest global fixed income investor. We offer a wide range of local and global investments, from Govies to High Yield Bonds, which are actively managed either as a separate fund or as part of a tailored package.