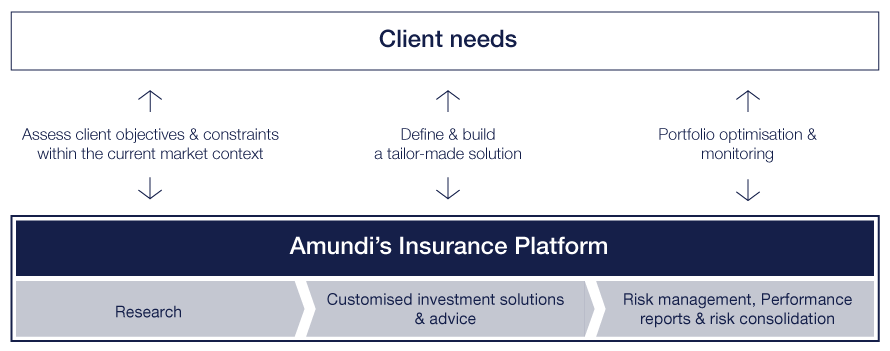

With knowledge gained from over 25 years of experience, Amundi has the expertise to develop investment solutions tailored to insurers’ specific accounting, financial and regulatory requirements. We’re proud to work with over 100 external insurance clients located in 14 countries1.